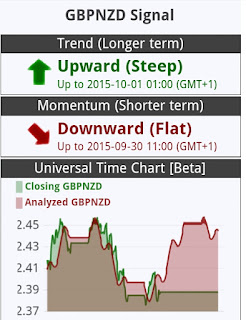

Recently, one of researching firms has pointed out that Babk of England will not cut the interest rate until 2016. In this sense, GBP is not stronger than that anticipated before.

GBP has been particularly weak against most of major currencies for the last 2 weeks. The trend and momentum now indicates the trend reversal for short term. Particularly, GBPNZD is expected upward steeply.

FOREX FLYER is a source of analysis tips for forex, investment and trading. Official blog of QROSS X and Newsensus.

Translate to your language:)

Wednesday, 30 September 2015

Tuesday, 29 September 2015

GBPJPY trend & momentum 29-Sep-2015

GBPJPY is nearly the lowest level since last May, currently staying around 181.50.

Financial market is volatile and chaotic today. Glencore, the stock price is nearly 70.00, and it recorded more than 300 about 4 months ago. One of Japanese shipping company is going to be under administration, due to extraordinary loss expected.

Downside of this crash is unpredictable, but the trend and momentum in GBPJPY is indicating the trend is reversed for a coming week against the downward trend in last 2 weeks.

If you have confidence to change this uncertainty to profit, Forex Signal by QROSS X will help your forex trading.

Financial market is volatile and chaotic today. Glencore, the stock price is nearly 70.00, and it recorded more than 300 about 4 months ago. One of Japanese shipping company is going to be under administration, due to extraordinary loss expected.

Downside of this crash is unpredictable, but the trend and momentum in GBPJPY is indicating the trend is reversed for a coming week against the downward trend in last 2 weeks.

If you have confidence to change this uncertainty to profit, Forex Signal by QROSS X will help your forex trading.

Saturday, 26 September 2015

Credit Default Swap market signals another trend? 26-Sep-2015

Since the beginning of this year, global financial market have been volatile and chaotic in uncertainty of geopolitics and economics. You easily remember Chinese stock market crashed recently, but we have experienced several events from beginning of 2015, which have driven the market.

(Remarkable events in 2015)

Jan 2015: Swiss Franc Jumped 30% - 40% against Euro, and massively gone up against other currencies.

Jan 2015: Greek election. SYRIZA lead by Alexis Tsipras became a leading party in Greek government.

May 2015: UK general election. Although the leading party is Conservative party lead by David Cameron, opposition parties are restructured in larger scale. Labour and Lib-Dem lost certain number of seats, but Scottish National Party (SNP) got more seats.

Jun - Sep 2015: Chinese stock market have continued going down, and other market including in UK, US and Japan have declined.

Aug 2015: Chinese yuan (CNY) has been devalued.

Sep 2015: Refugee crisis got attention. Number of refugees in this year became record high in Germany.

Sep 2015: Volkswagen's emissions scandal. German car industry could face slowdown.

Long term trend 2015: Natural resources including crude oil and iron ore, the price continues going down.

Long term trend 2015: Currency has been weak in emerging market, including BRL, ZAR, MXN, MYR or PHP.

Long term trend 2015: Currencies of natural resources provider, such as AUD, NZD and CAD has been weak as the interest rate has been lowered.

By the way, today's subject is about Credit Default Swap (=CDS) market. While such events have been occurred since the beginning of 2015, CDS market indicates some sense of another trend.

CDS market might be unfamiliar with some of you, but it is basically measured in credit spread for each entity. When the spread is widen, the market expect the referenced entity is losing its credit. When the spread is tighten, the market expect the entity is getting credit.

Around 2010 - 2012, it was sovereign bond crisis, particularly Greek bond yield has shot up record high. 10 year Greek bond yield has gone up 25% - 30% at the peak. Since then, the market has been calm down. Compared with that time, the credit market is still stable.

However, CDS spread have been widening in some economic zones since early 2015. For example, Spanish banking industry have been getting wider spread sharply. Spain is facing political uncertainty about discussion of Catalonian independence. A political party, Podemos, could add another shot into the market.

On the other side of the planet, Australian banking industry have been getting wider CDS spread, too. Australian economy highly depends on Chinese demand, and the demand has been slowing down since beginning of this year. Chinese stock market crisis may drive the Australian CDS market further.

American, British, German and Japanese banking industries are relatively tighten.

It may be too soon to say crisis about Chinese stock market crush. It could be just the beginning of chaos.

If you have confidence to change this uncertainty to profit, Forex Signal by QROSS X will help your forex trading.

(Remarkable events in 2015)

Jan 2015: Swiss Franc Jumped 30% - 40% against Euro, and massively gone up against other currencies.

Jan 2015: Greek election. SYRIZA lead by Alexis Tsipras became a leading party in Greek government.

May 2015: UK general election. Although the leading party is Conservative party lead by David Cameron, opposition parties are restructured in larger scale. Labour and Lib-Dem lost certain number of seats, but Scottish National Party (SNP) got more seats.

Jun - Sep 2015: Chinese stock market have continued going down, and other market including in UK, US and Japan have declined.

Aug 2015: Chinese yuan (CNY) has been devalued.

Sep 2015: Refugee crisis got attention. Number of refugees in this year became record high in Germany.

Sep 2015: Volkswagen's emissions scandal. German car industry could face slowdown.

Long term trend 2015: Natural resources including crude oil and iron ore, the price continues going down.

Long term trend 2015: Currency has been weak in emerging market, including BRL, ZAR, MXN, MYR or PHP.

Long term trend 2015: Currencies of natural resources provider, such as AUD, NZD and CAD has been weak as the interest rate has been lowered.

By the way, today's subject is about Credit Default Swap (=CDS) market. While such events have been occurred since the beginning of 2015, CDS market indicates some sense of another trend.

CDS market might be unfamiliar with some of you, but it is basically measured in credit spread for each entity. When the spread is widen, the market expect the referenced entity is losing its credit. When the spread is tighten, the market expect the entity is getting credit.

Around 2010 - 2012, it was sovereign bond crisis, particularly Greek bond yield has shot up record high. 10 year Greek bond yield has gone up 25% - 30% at the peak. Since then, the market has been calm down. Compared with that time, the credit market is still stable.

However, CDS spread have been widening in some economic zones since early 2015. For example, Spanish banking industry have been getting wider spread sharply. Spain is facing political uncertainty about discussion of Catalonian independence. A political party, Podemos, could add another shot into the market.

On the other side of the planet, Australian banking industry have been getting wider CDS spread, too. Australian economy highly depends on Chinese demand, and the demand has been slowing down since beginning of this year. Chinese stock market crisis may drive the Australian CDS market further.

American, British, German and Japanese banking industries are relatively tighten.

It may be too soon to say crisis about Chinese stock market crush. It could be just the beginning of chaos.

If you have confidence to change this uncertainty to profit, Forex Signal by QROSS X will help your forex trading.

Labels:

BRL,

Credit risk,

Economy,

Long term,

MXN,

MYR,

PHP,

Stock market,

ZAR

Friday, 25 September 2015

GBPAUD trend & momentum 25-Sep-2015

GBPAUD has stayed above 2.10 for a long time while it was 1.40 - 1.50 in 2012.

The trend and momentum indicates GBPAUD is expected downward trend for a coming week. Since Australian prime minister has changed, Australian policy has to be observed how it affects to the financial market.

The trend and momentum indicates GBPAUD is expected downward trend for a coming week. Since Australian prime minister has changed, Australian policy has to be observed how it affects to the financial market.

Sunday, 13 September 2015

How difficult situation to lift interest rate? 13-Sep-2015

It has been a while since discussion was started about lifting the interest rate. Watching the market consensus, it seems that the rate hike is triggered by US or UK.

For a last few years, however, the market has moved against the rate rise. There have been multiple factors, listed below, preventing US, UK or others to lift their interest rate in the global economy.

1. Rate cutting in other nations

Particularly in the last year, but for a last few years, the policy rates have been cut remarkably in several nations, such as Australia, New Zealand, Canada, Sweden, Denmark, Switzerland, ... Some of them has reached at negative rates. As a result of those rate cutting, USD and GBP has been stronger against currencies, particularly against AUD, NZD and CAD.

In the current market, US or UK rate hike will lead to their currency value gone up. It may be good for importer in those nations, but it would suffer the exporter as USD and GBP are already expensive than other currencies relatively.

There is certain level of concern about deflation risk as their currency values are already higher and rate hike lift the currency value further.

2. Price for oil and natural resources down sharply

WTI crude oil price currently stays around 44.6, and it was around 90 just a year ago. While media have mainly broadcasted that the crude oil price has been going down, other natural resources, such as Iron Ore, the price has gone down in parallel with the oil price. Chinese demand for the oil and natural resources have been shrink for a last few years due to their growth slowing down.

The lower price is not bad for consumers and importers, but it still brings deflation risk into the world. For the exporters such as Australia or Canada, weak demand for oil and natural resources suffer their economy.

Local 10 >> Goldman Sachs: Oil could hit $20

Forget $40 a barrel oil. Prices could plummet to $20 as a massive supply glut persists until the end of next year.

That's the view of Goldman Sachs, which published an oil report Friday headlined "Lower for even longer."

The bank's commodities team slashed its forecast for average prices in 2016 to $45 per barrel from $57, but said the risks of a collapse to $20 were growing.

Under the risk at deflation, it is difficult decision whether rate hike or not. But at the same time, keeping loose monetary policy, there is eventually a room that inflation badly suffer the people's life.

Even in such situation, Bank of England is likely under pressure to lift their interest rate, as BOE announced the rate must rise relatively soon.

CITY A.M. >> Interest rates must rise "relatively soon" says Bank of England's Martin Weale

Interest rates will need to rise "relatively soon", Bank of England rate setter Martin Weale has said.

The hawkish member of the BoE's monetary policy committee (MPC) has said inflation is likely to rise above the central bank's two per cent inflation target "in two to three years' time", which needs to be reflected in policy now.

Weale is the second BoE official in as many days to point to a rate rise. Fellow member of the nine-strong MPC, Kristin Forbes, said on Friday rates will rise sooner rather than later, because the appreciation of sterling may be less of a drag on inflation and import prices than first thought.

Keep yourself to follow the global economy more efficiently, why not use Newsensus. Available on Google Play.

For a last few years, however, the market has moved against the rate rise. There have been multiple factors, listed below, preventing US, UK or others to lift their interest rate in the global economy.

1. Rate cutting in other nations

Particularly in the last year, but for a last few years, the policy rates have been cut remarkably in several nations, such as Australia, New Zealand, Canada, Sweden, Denmark, Switzerland, ... Some of them has reached at negative rates. As a result of those rate cutting, USD and GBP has been stronger against currencies, particularly against AUD, NZD and CAD.

In the current market, US or UK rate hike will lead to their currency value gone up. It may be good for importer in those nations, but it would suffer the exporter as USD and GBP are already expensive than other currencies relatively.

There is certain level of concern about deflation risk as their currency values are already higher and rate hike lift the currency value further.

2. Price for oil and natural resources down sharply

WTI crude oil price currently stays around 44.6, and it was around 90 just a year ago. While media have mainly broadcasted that the crude oil price has been going down, other natural resources, such as Iron Ore, the price has gone down in parallel with the oil price. Chinese demand for the oil and natural resources have been shrink for a last few years due to their growth slowing down.

The lower price is not bad for consumers and importers, but it still brings deflation risk into the world. For the exporters such as Australia or Canada, weak demand for oil and natural resources suffer their economy.

Local 10 >> Goldman Sachs: Oil could hit $20

Forget $40 a barrel oil. Prices could plummet to $20 as a massive supply glut persists until the end of next year.

That's the view of Goldman Sachs, which published an oil report Friday headlined "Lower for even longer."

The bank's commodities team slashed its forecast for average prices in 2016 to $45 per barrel from $57, but said the risks of a collapse to $20 were growing.

Under the risk at deflation, it is difficult decision whether rate hike or not. But at the same time, keeping loose monetary policy, there is eventually a room that inflation badly suffer the people's life.

Even in such situation, Bank of England is likely under pressure to lift their interest rate, as BOE announced the rate must rise relatively soon.

CITY A.M. >> Interest rates must rise "relatively soon" says Bank of England's Martin Weale

Interest rates will need to rise "relatively soon", Bank of England rate setter Martin Weale has said.

The hawkish member of the BoE's monetary policy committee (MPC) has said inflation is likely to rise above the central bank's two per cent inflation target "in two to three years' time", which needs to be reflected in policy now.

Weale is the second BoE official in as many days to point to a rate rise. Fellow member of the nine-strong MPC, Kristin Forbes, said on Friday rates will rise sooner rather than later, because the appreciation of sterling may be less of a drag on inflation and import prices than first thought.

Keep yourself to follow the global economy more efficiently, why not use Newsensus. Available on Google Play.

Tuesday, 8 September 2015

2 most important things for Forex & CFD traders 8-Sep-2015

I introduced 8 things to become a nomad trader on this blog, and today I would like to mention "2 things most important things for Forex & CFD traders" which more focus on trading itself for the successful trading, while the last topics, 8 things to ..., hinted about traders' life style.

The most important things for traders are merely two things below, but I understand most of beginners are trapped in trading without those disciplines.

Your own strategy

Beginners tend to trade by their judgement from subjective view. It sometimes may work, or always work if you were the trading god. However, in other words, there are no rules, patterns nor empirical justification.

Before you trade with your money, you should have certain strategy which characterize your trading rule.

Trading by technical analysis, you will look at technical indicators on the chart, and you will long or short when the technical indicator reached at specific figure.

Trading by fundamentals analysis, you will look at economic indicators such as policy rates, GDP growth, unemployment rate, .... The market is driven by those economic indicators when the indicators are updated.

Lastly, the simplest rule is to decide how much to take profit and how much to allow loss. Particularly, traders tend to fail without stop loss.

Never break your strategy but improve the strategy

Even if you set up your strategy, you are still a human and sometimes can be emotional. When your position indicates unrealized profit, you may want to take the profit despite the signal indicating the profit being bigger. When your position indicates unrealized loss, you may believe the loss eventually become profit despite the signal indicating the loss being bigger.

Ultimately, no one knows future. But in trading, your own strategy is a only thing to predict future. If you think your strategy is insufficient, you should have further analysis and improve the strategy instead of emotional trading.

We are providing our own technical indicators which are called FX trend & momentum. Download App "Forex Signal by QROSS X" at Google Play.

The most important things for traders are merely two things below, but I understand most of beginners are trapped in trading without those disciplines.

Your own strategy

Beginners tend to trade by their judgement from subjective view. It sometimes may work, or always work if you were the trading god. However, in other words, there are no rules, patterns nor empirical justification.

Before you trade with your money, you should have certain strategy which characterize your trading rule.

Trading by technical analysis, you will look at technical indicators on the chart, and you will long or short when the technical indicator reached at specific figure.

Trading by fundamentals analysis, you will look at economic indicators such as policy rates, GDP growth, unemployment rate, .... The market is driven by those economic indicators when the indicators are updated.

Lastly, the simplest rule is to decide how much to take profit and how much to allow loss. Particularly, traders tend to fail without stop loss.

Never break your strategy but improve the strategy

Even if you set up your strategy, you are still a human and sometimes can be emotional. When your position indicates unrealized profit, you may want to take the profit despite the signal indicating the profit being bigger. When your position indicates unrealized loss, you may believe the loss eventually become profit despite the signal indicating the loss being bigger.

Ultimately, no one knows future. But in trading, your own strategy is a only thing to predict future. If you think your strategy is insufficient, you should have further analysis and improve the strategy instead of emotional trading.

We are providing our own technical indicators which are called FX trend & momentum. Download App "Forex Signal by QROSS X" at Google Play.

Subscribe to:

Comments (Atom)